Debt Management Plan Singapore: Your Course to Financial Liberty

Debt Management Plan Singapore: Your Course to Financial Liberty

Blog Article

The Comprehensive Overview to Producing an Effective Financial Obligation Administration Plan for Conquering Financial Difficulties

Navigating economic obstacles requires a tactical method to financial debt administration, emphasized by a thorough understanding of one's financial landscape. By thoroughly examining earnings, expenditures, and outstanding debts, individuals can develop a clear structure for their economic objectives.

Recognizing Your Financial Situation

Numerous people discover themselves unclear concerning their economic standing, which can complicate the debt administration procedure. A clear understanding of one's monetary scenario is crucial for effective debt management. This involves conducting a detailed assessment of revenue, expenses, properties, and responsibilities. A detailed assessment assists in identifying real economic photo and highlights areas that require immediate attention.

To begin, people must provide all incomes, including wages, sideline, and passive revenue streams. Next, a detailed account of month-to-month costs should be recorded, categorizing them right into fixed and variable prices. This allows for an exact computation of non reusable earnings, which is crucial in establishing how a lot can be assigned towards debt payment.

Furthermore, people should put together a checklist of all financial debts, noting the amounts owed, rates of interest, and repayment terms. This will give insight into which financial debts are much more important and may need prioritization. Recognizing one's financial circumstance not just aids in efficient financial obligation monitoring however additionally lays a solid foundation for future monetary preparation. This action is critical in making sure that people can browse their monetary difficulties extra efficiently and work in the direction of attaining lasting stability.

Establishing Clear Financial Goals

Establishing clear economic objectives is an important next action after getting a detailed understanding of your monetary circumstance. These objectives offer as a roadmap, directing your initiatives and choices as you work in the direction of accomplishing financial stability.

Make use of the SMART standards-- Certain, Measurable, Possible, Appropriate, and Time-bound-- to guarantee your goals are well-defined. For example, rather than specifying, "I wish to save even more money," define, "I will save $5,000 for a reserve within the next year." This clarity not only boosts emphasis but also enables better monitoring of your progress.

Furthermore, prioritize your goals according to their seriousness and importance. This prioritization aids in guiding your sources efficiently, ensuring that necessary objectives are attended to first. By setting clear economic goals, you produce an organized method to handling your debts and navigating monetary obstacles, ultimately placing on your own for a more safe economic future.

Establishing a Spending Plan Strategy

Producing a budget strategy is crucial for handling your finances effectively and ensuring that you remain on track toward achieving your financial goals. A well-structured budget plan works as a roadmap, assisting your costs and conserving choices while assisting you determine areas for enhancement.

To create a reliable budget strategy, start by providing all income sources, including salary, perks, and any side profits. Next, categorize your expenses right into taken care of and variable expenses. Fixed expenses, such as rental fee or home mortgage payments, stay continuous, while variable expenses, like groceries and entertainment, can rise and fall.

As soon as you have a clear photo of your income and expenditures, allot funds per classification based on your financial top priorities. Make sure that your budget plan enables financial savings and debt repayment, and take into consideration using the 50/30/20 guideline-- 50% for demands, 30% for desires, and 20% for savings and financial debt.

Evaluation your budget month-to-month to change for any kind of changes in earnings or expenses, and track your costs to ensure adherence (debt management plan singapore). By devoting to a regimented budgeting procedure, you can acquire control over your funds and pursue economic stability

Exploring Financial Debt Repayment Approaches

Financial debt repayment methods are critical for recovering economic security and minimizing the burden of outstanding commitments. Various approaches can be used, each created to properly tackle the one-of-a-kind circumstances of individuals dealing with financial obligation challenges.

One popular approach is the financial obligation snowball technique, which focuses on settling the tiniest debts initially. This approach supplies emotional motivation as individuals experience fast victories, fostering a sense of success. Conversely, the financial obligation avalanche approach focuses on settling financial debts with the highest rate of interest prices first, eventually reducing the total rate of interest paid with time.

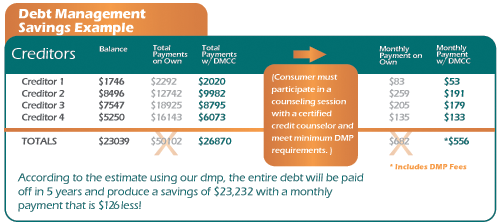

Another effective method is financial debt consolidation, which includes integrating numerous debts into a solitary car loan with a reduced passion rate. This not only simplifies the payment process however can additionally lower monthly repayments. Moreover, discussing with financial institutions for extra favorable terms, such as reduced rates of interest or extended repayment durations, can ease economic pressure.

Preserving Financial Technique

Effective financial debt settlement approaches pivot not just on the techniques my link selected however likewise on the self-control exercised throughout the process. Keeping economic technique is necessary for making certain that people comply with their financial debt monitoring plans and achieve their financial goals. This entails producing a structured budget that focuses on financial obligation settlement while permitting needed living costs.

One effective approach to growing self-control is to set clear, possible goals. Individuals need to damage down their general debt right into smaller, convenient targets, which can assist foster explanation a feeling of achievement as each goal is fulfilled. Furthermore, on a regular basis examining one's financial scenario and changing the spending plan as needed can reinforce dedication to the plan.

Inevitably, preserving economic discipline calls for consistent initiative and mindfulness (debt management plan singapore). By focusing on financial obligation settlement and adopting prudent investing practices, people can navigate their monetary challenges successfully and lead the way for a more safe economic future

Conclusion

In final thought, establishing an efficient financial obligation administration plan necessitates an extensive understanding of one's financial situation, coupled with the formulation of clear, achievable goals. By sticking to these concepts, people can dramatically boost their capacity to handle financial obligation and accomplish financial well-being.

Browsing economic difficulties requires a tactical method to financial obligation monitoring, highlighted by an extensive understanding of one's financial landscape. Comprehending one's financial scenario not just aids in reliable financial debt monitoring however additionally lays a strong structure for Learn More future economic preparation.Establishing clear economic goals is an important next step after getting a comprehensive understanding of your financial scenario. By setting clear financial objectives, you create an organized technique to managing your financial debts and navigating economic difficulties, ultimately positioning on your own for a much more secure monetary future.

Report this page